CMOS image sensors stall in 2022 ‘perfect storm’

Optoelectronics’ biggest product category is set to suffer its first sales decline in 13 years due to the smartphone slump, weak growth of cameras in handsets and a weak global economy, according to a update report

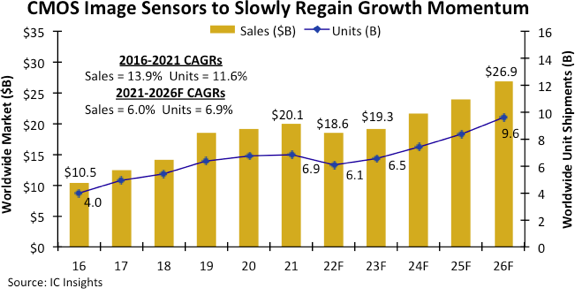

For most of the past two decades, the strong growth of CMOS image sensors has propelled this product category to the top of the optoelectronics market, in terms of sales volume, generating more than 40% of revenue. total annual opto-semiconductor. In 2022, however, the CMOS image sensor market category is on track to experience its first decline in 13 years with sales expected to fall 7% to $18.6 billion and unit shipments expected to fall. drop 11% to 6.1 billion worldwide, according to IC Insights. McClean Report Service August 3rd Quarter Update (Figure 1).

Figure 1

The forecast decline for 2022 in CMOS image sensors comes after two years of weak sales growth in 2020 (+4%) and 2021 (+5%). This year’s sales decline reflects overall weakness in consumer smartphones and laptops equipped with digital cameras for video conferencing following an increase in demand for internet connections and online conferencing capabilities during the virus pandemic Covid-19. The Q3 Update forecast shows a modest recovery for CMOS image sensors next year, with market revenue growing 4% to $19.3 billion, then 13% in 2024 to reach a new record of $21.7 billion.

Deteriorating global economic conditions

In addition to weak demand for consumer mobile phones and laptops, CMOS image sensors have been negatively impacted by deteriorating global economic conditions resulting from high inflation and soaring energy costs. caused by the Russian war in Ukraine as well as US trade bans on China, recent Covid-19 virus lockdowns in Chinese manufacturing hubs, and slowing growth in the number of cameras packed into new smartphones. Some high-end smartphone models pack five or more cameras, but the average for most handsets has remained at three (one on the front, facing the user for “selfie” photos and two main cameras at the back of the phones). IC Insights third-quarter update report says some officials in China have described image sensor market conditions as a “perfect storm,” combining a slowdown in consumer smartphone shipments from mid of range and an unforeseen break in the increase in the number of integrated cameras designed in new handsets. .

CMOS image sensor market leader Sony, which accounted for approximately 43% of CMOS image sensor sales worldwide in 2021, reported a 12.4% sequential decline in image sensor dollar revenue (-2% in Japanese yen) during the company’s fiscal first quarter, ended June 2022. During the first half of the 2022 calendar, Sony struggled to meet image resolution requirements for camera phones and its sales of CMOS image sensors to major Chinese system makers have been curtailed by U.S. trade bans. Sony still expects excess phone and image sensor inventory to be reduced by early 2023 and market conditions to “normalize” in the second half of its current fiscal year (ending March next).

Nearly two-thirds of CMOS image sensors are used in cellphones, and that share is expected to drop to around 45% by 2026, according to the McClean Report’s 3Q update. A slow but steady recovery in CMOS image sensors is expected to be driven by a new purchase cycle of smartphone upgrades and more integrated cameras being added in other systems, especially for automotive automation capabilities, medical applications and intelligent security networks. The 3Q update shows that sales of CMOS image sensors grow at a CAGR of 6.0% from 2021 to 2026 to reach $26.9 billion in the last forecast year. CMOS image sensor shipments are expected to grow at a CAGR of 6.9% between 2021 and 2026, to reach 9.6 million units.

Comments are closed.